All Categories

Featured

Table of Contents

The are whole life insurance policy and global life insurance policy. grows money worth at an ensured rate of interest and likewise through non-guaranteed rewards. expands cash money worth at a repaired or variable rate, relying on the insurance firm and policy terms. The money worth is not added to the survivor benefit. Cash money value is a function you take benefit of while alive.

After 10 years, the cash money value has grown to around $150,000. He obtains a tax-free financing of $50,000 to start a service with his brother. The policy loan rates of interest is 6%. He repays the finance over the next 5 years. Going this course, the rate of interest he pays goes back right into his plan's money value instead of a financial institution.

Infinite Bank Statement

The concept of Infinite Financial was produced by Nelson Nash in the 1980s. Nash was a money expert and follower of the Austrian college of economics, which supports that the worth of items aren't clearly the result of typical financial frameworks like supply and need. Rather, individuals value money and goods in different ways based upon their economic standing and requirements.

One of the pitfalls of standard banking, according to Nash, was high-interest prices on finances. Long as financial institutions established the passion rates and lending terms, individuals didn't have control over their very own wide range.

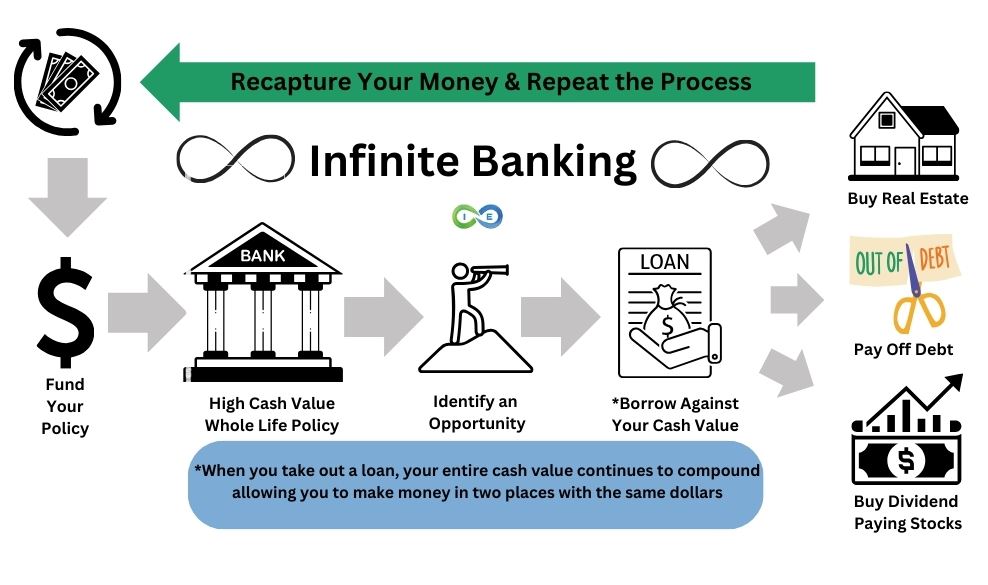

Infinite Financial requires you to possess your economic future. For goal-oriented people, it can be the best financial tool ever. Below are the advantages of Infinite Financial: Arguably the single most advantageous facet of Infinite Banking is that it improves your capital. You do not require to undergo the hoops of a typical bank to get a car loan; simply demand a policy financing from your life insurance coverage business and funds will certainly be provided to you.

Dividend-paying whole life insurance is really low threat and supplies you, the policyholder, a lot of control. The control that Infinite Banking offers can best be organized right into 2 groups: tax benefits and asset defenses - infinite banking wikipedia. One of the factors whole life insurance policy is optimal for Infinite Banking is how it's exhausted.

How To Set Up Infinite Banking

When you make use of entire life insurance for Infinite Banking, you enter right into an exclusive contract in between you and your insurance coverage firm. This privacy supplies particular asset protections not discovered in various other monetary lorries. Although these securities might differ from one state to another, they can include protection from property searches and seizures, protection from reasonings and defense from financial institutions.

Entire life insurance coverage plans are non-correlated properties. This is why they work so well as the financial structure of Infinite Banking. No matter of what happens in the market (supply, actual estate, or otherwise), your insurance coverage plan maintains its well worth.

Market-based financial investments grow wide range much faster yet are exposed to market variations, making them inherently risky. What happens if there were a 3rd container that used security yet likewise modest, guaranteed returns? Entire life insurance is that third container. Not just is the rate of return on your entire life insurance policy policy assured, your survivor benefit and costs are likewise guaranteed.

Below are its major advantages: Liquidity and availability: Plan finances provide prompt access to funds without the constraints of conventional financial institution financings. Tax obligation performance: The cash value expands tax-deferred, and plan lendings are tax-free, making it a tax-efficient tool for building wide range.

Bioshock Infinite Bank Of Columbia

Asset defense: In numerous states, the cash value of life insurance policy is protected from lenders, including an additional layer of economic security. While Infinite Financial has its advantages, it isn't a one-size-fits-all service, and it features substantial downsides. Right here's why it might not be the finest method: Infinite Banking often calls for elaborate plan structuring, which can perplex insurance policy holders.

Visualize never ever having to worry concerning financial institution finances or high interest rates again. That's the power of limitless banking life insurance policy.

There's no set financing term, and you have the flexibility to choose on the payment routine, which can be as leisurely as paying back the lending at the time of death. This adaptability reaches the maintenance of the loans, where you can go with interest-only settlements, keeping the funding equilibrium level and manageable.

Holding money in an IUL repaired account being attributed passion can frequently be far better than holding the money on down payment at a bank.: You've constantly imagined opening your own bakery. You can borrow from your IUL policy to cover the initial expenditures of renting an area, acquiring devices, and hiring team.

Infinite Banking Insurance

Personal loans can be gotten from traditional financial institutions and cooperative credit union. Here are some bottom lines to consider. Credit report cards can give a flexible means to obtain cash for very temporary durations. Borrowing money on a credit card is generally really costly with yearly percentage prices of interest (APR) commonly reaching 20% to 30% or even more a year.

The tax treatment of plan car loans can differ considerably depending upon your nation of residence and the details regards to your IUL policy. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, policy car loans are typically tax-free, providing a considerable advantage. In other territories, there may be tax obligation implications to take into consideration, such as prospective taxes on the finance.

Term life insurance coverage just gives a survivor benefit, with no cash money value accumulation. This implies there's no cash money value to obtain against. This article is authored by Carlton Crabbe, Principal Executive Officer of Capital forever, a specialist in providing indexed universal life insurance policy accounts. The information supplied in this short article is for academic and informational purposes just and ought to not be construed as economic or financial investment recommendations.

For financing officers, the extensive guidelines imposed by the CFPB can be seen as cumbersome and limiting. Initially, loan police officers often argue that the CFPB's guidelines create unneeded red tape, leading to even more documents and slower financing processing. Guidelines like the TILA-RESPA Integrated Disclosure (TRID) guideline and the Ability-to-Repay (ATR) needs, while aimed at shielding consumers, can result in delays in shutting bargains and enhanced functional expenses.

Latest Posts

How To Use Whole Life Insurance As A Bank

Using Life Insurance As A Bank

Bank Infinity